As the cryptocurrency world navigates through the recent approval of Bitcoin spot trading funds and the anticipated halving event, opinions regarding price fluctuations have been varied and sometimes conflicting.

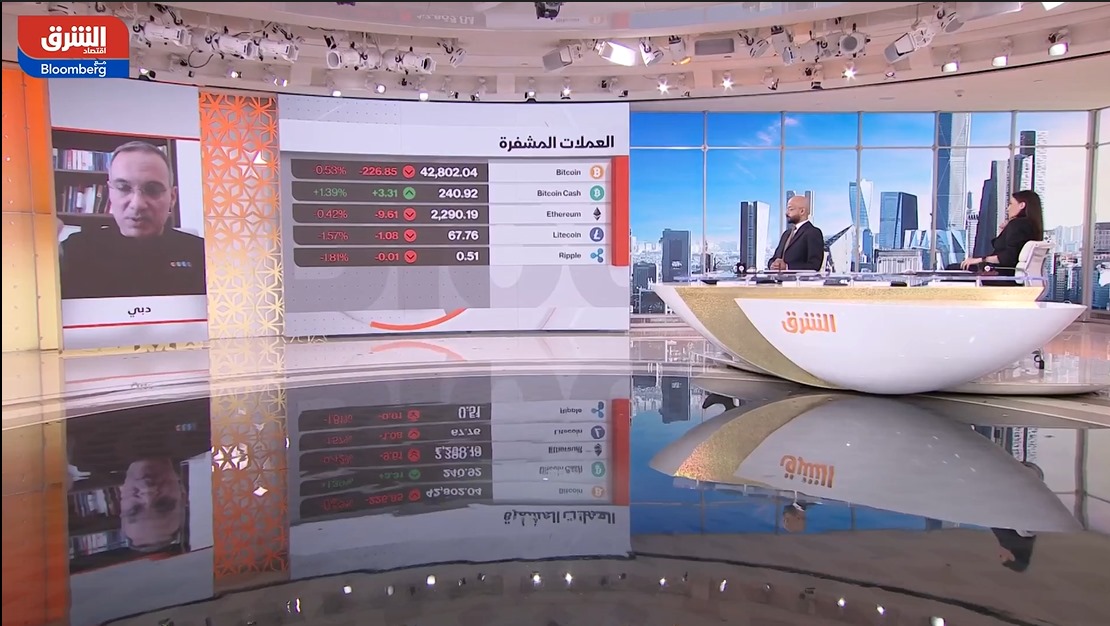

Addressing these concerns, Asharq News recently hosted a conversation with Walid Abu Zaki, the Founder and CEO of UNLOCK Blockchain, shedding light on these critical topics.

Walid commenced the discussion by urging patience and perspective: “We are at the beginning of a stage, and we cannot judge the performance of Bitcoin over a period of time of less than a month.” He emphasized the importance of distinguishing between the period before and after the launch of Bitcoin spot trading funds.

In just twenty days post-launch, the net financial inflows into Bitcoin totaled approximately 35,000 bitcoins, equivalent to a remarkable one and a half billion dollars—a figure that represents the entire financial inflow recorded for Bitcoin in the year 2023.

Drawing attention to the distinction among various trading funds, Walid highlighted the significance of Grayscale’s role in the market. He explained “Grayscale had a closed Bitcoin fund since 2013, containing approximately 617,000 Bitcoins. With approval from the Securities and Exchange Commission (SEC), this fund transitioned into a trading fund, marking a significant opportunity for investors to gain profits.”

While Grayscale sold about 150,000 bitcoins initially, other funds demonstrated strong buying activity, contributing to the substantial net inflows.

Discussing the impact of the upcoming halving, Walid emphasized the fundamental economic principle of supply and demand. He noted, “The increasing growth in demand will be met with a scarcity of supply, indicating the direction of Bitcoin’s price movement.”

With the ten funds now representing over 3.3% of Bitcoin’s total supply, Walid anticipates a continued increase in this percentage, underlining the bullish trajectory for Bitcoin’s value.

Regarding market sentiment, Walid pointed to the approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission as a pivotal moment signifying Bitcoin’s evolution into a mainstream asset comparable to gold. He said, “The legitimacy of Bitcoin as a trading asset is now indisputable.” Additionally, he highlighted global interest in issuing spot trading funds, exemplified by considerations in countries like Hong Kong.

Addressing concerns about the direct impact of demand on price movements, Walid acknowledged the complexity of the ecosystem. He explained that many funds acquire Bitcoin assets through channels like Grayscale or directly from miners to obtain “virgin Bitcoin,” which bypasses certain verification and compliance processes associated with traded assets.

In light of these discussions, Walid emphasized the prevailing optimism surrounding Bitcoin’s future. With projections ranging from $160,000 to $200,000 within the year, the consensus among many stakeholders remains bullish.

In his view, he believes that the basic factors of supply and demand will strongly affect Bitcoin’s price. With strong demand, Walid is sure that Bitcoin will keep going up.

As the cryptocurrency market changes, how much people want Bitcoin and how they feel about it will definitely affect how valuable it becomes.

The post Decoding Bitcoin’s Price: Insights from Asharq News Conversation with UNLOCK Blockchain appeared first on UNLOCK Blockchain.